Automating the process eliminates manual input, which can lead to mistakes. It also eliminates the need for someone to spend time processing bills, which can free up employees to do other tasks. Automation can also help ensure that bills are processed accurately and on time, reducing late fees and penalties. The final step in the billing process is to collect payment from the customer. Once the invoice has been sent, the business waits for the customer to pay. This can be done through various methods, such as online payments or over the phone.

What are the advantages of billing statements?

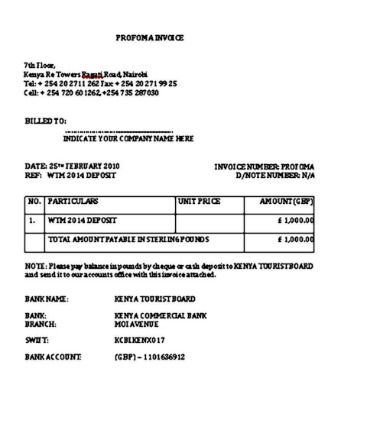

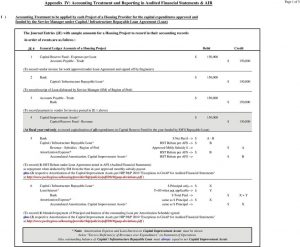

In this billing method, invoices are generated in tandem with costs incurred on a routine, monthly, or bi-monthly basis. After all the necessary financial information about the sale has been collected and reviewed, it’s time to put the data together and create your invoice. Whomever you choose, be sure to read plenty of reviews and testimonials about your potential accountant. As important as it is to understand how business accounting works, you don’t have to do it alone. Not only will this help offset some upfront expenses, but it will also contribute to your business’s overall credit. Also, Corporations and LLCs are required to have a separate line of credit outside their personal accounts.

Sending bills to customers

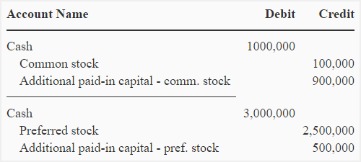

Prepaid billing is a type of billing where a customer pays for goods or services in advance of receiving them. This is often used in industries where there is a need for recurring services, such as phone or internet service providers. In prepaid billing, the customer pays for a certain amount of usage upfront, and then the service is provided until the prepaid amount runs out. Invoice billing is https://www.online-accounting.net/how-to-calculate-stockholders-039-equity-for-a/ a method of billing where a seller sends a document (the invoice) to a buyer with a detailed description of goods or services provided and the amount owed. It’s like a friendly reminder from a friend that you owe them money, except it’s a business and they mean business. Billing is a critical aspect of business operations that ensures the timely collection of revenue from customers or clients.

We and our partners process data to provide:

In the world of accounting, billing refers to the process of generating invoices and requesting payment for goods or services provided by a company. So, if you need a way to keep tabs with your business’s financial status while issuing invoices and collecting payments from customers, you need ReliaBills. Try it for free today and see how it can help your business streamline its accounting and billing processes. To access ReliaBill’s full array of features, you will need to upgrade your account to ReliaBills PLUS for only $24.95. Basic billing refers to a simple invoicing process where a business creates and sends invoices to customers for products or services provided.

That’s why most businesses nowadays opt for accounting and invoicing software to automate the process of making an invoice. Billing is defined as the step-by-step process of requesting payment from customers by issuing invoices. An invoice is the commercial document businesses use to request payment and record sales. The cash method recognizes revenue and expenses on the day they’re actually received or paid.

- Costs are typically billed in sequence, with the most recent activity billed first.

- Just upload your form 16, claim your deductions and get your acknowledgment number online.

- Once it’s been created, the invoice can be delivered – usually by mail or as an email attachment.

- The cost of goods sold (COGS) or cost of sales (COS) is the cost of producing your product or delivering your service.

Part of the usability includes helping you maintain compliance with tax laws. You’ll want a billing system that can calculate and apply appropriate taxes automatically. An invoice is a document requesting payment for goods or services, while a receipt is a document showing proof of payment. It may not be the most glamorous aspect, but it helps keep things organized and ensures that the money keeps flowing in.

They can find redundancies and places where the company could cut costs. This software can interface with billing software to ensure that sales data is correctly captured and updated. It lets the customer know what to expect and helps ensure the company is paid on time. Standard payment terms include net 30 (due in 30 days), net 60 (due in 60 days), and net 90 (due in 90 days). Billing statements enable both parties to keep track of payments made and any outstanding amounts due. These records make it easier to manage cash flow, resolve discrepancies, and identify overdue accounts that may require follow-up or collection efforts.

An income statement shows your company’s profitability and tells you how much money your business has made or lost. A business with healthy (positive) equity is attractive to potential investors, lenders, and buyers. Investors and analysts also look at your business’s EBITDA, which stands for earnings before interest, taxes, depreciation, and amortization. However, you’ll need a holistic understanding of the subject as your business grows. It makes it easier for stakeholders to understand and compare performance because it separates it into short periods of time.

Unlock the secrets of successful sales management with billing statements – the unsung heroes of business transactions. These simple yet powerful tools document transactions and facilitate clear communication between parties involved in a sale. Billing statements represent the foundation for better financial decision-making. The date at which the billing cycle begins depends sales journal entry on various factors, including the type of service being offered and the customer’s needs. For example, an apartment complex may issue a bill for rent on the first day of every month, regardless of when tenants signed their individual leases. This style of billing cycle can simplify accounting while making it easier for tenants to remember the payment due date.

You may then be able to reach an agreement about what the supplier can do to put it right, or potentially agree on partial payment. It’s in your best interest to provide customers with flexibility in the payment methods you accept. A good payment process will help you manage and accept business-to-business (B2B) payments to streamline operations with your vendors and suppliers. Sending out professional and timely invoices is the first step in a solid billing system.

Here are a few ways most businesses record their financial transactions. Every transaction creates both accounts payable and accounts receivable for the customer and the vendor, respectively. So to get a better understanding, let’s discuss what Accounts Payable and Accounts Receivable are and the difference between them. Use Deskera’s invoice management software, to keep track of your invoices all in one place and establish an efficient cash flow system. While there are traditional methods of generating bills and invoices, cloud accounting platforms such as Deskera provide quick and easy-to-use bill and invoice creation tools.

For example, suppose a large corporate customer needs to lengthen the cycle from 30 days to 45 days for software-as-a-service (SaaS). If the creditworthiness of this customer is sound, the vendor will normally agree to do so. It is important because it simplifies the payment process for both the customer and the business. It allows customers https://www.business-accounting.net/ to make a one-time payment for a product or service, without having to worry about recurring charges. For businesses, one-time billing helps to reduce the complexity of managing ongoing subscriptions and payments. It also ensures that the business receives payment upfront, reducing the risk of non-payment or late payments.

The billing info to be reviewed will differ a bit depending on whether your business provides physical products or services. Optimised invoice components, host of configurations, multiple billing modes, and so on.. Not only can you invoice clients through these programs, but you can also conduct bookkeeping, payroll, and other accounting tasks.

Add Comment