You will find there are various quick and easy funding options including digital wallets. If you are a beginner then you will be pleased with the free educational content provided. There is also the option of a demo account so you can practice trading online without any risk. If you want to get started with a real account then the minimum deposit is just $50 which is relatively low compared to many other brokers. I have had an account with the broker for a few years now and have yet to run into any problems. All of my withdrawals have been processed in a timely manner and support has always been excellent.

LMFX Account Types 🗃

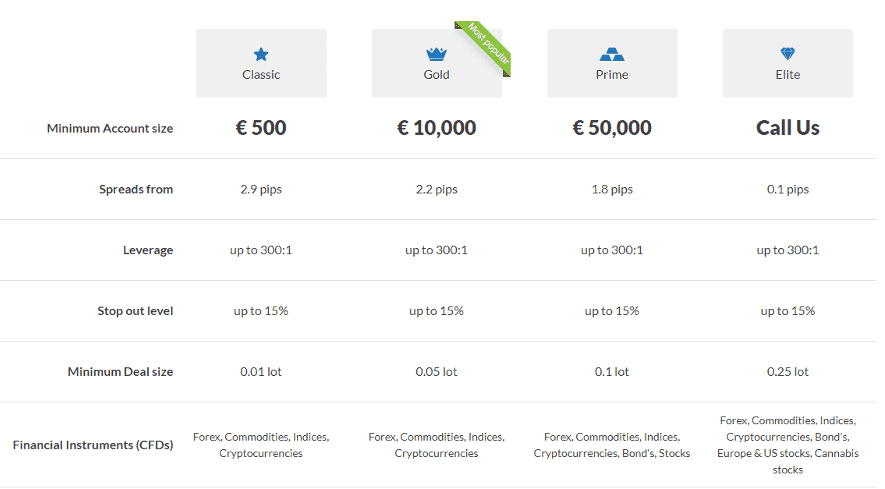

Other account types have wider spreads, with the Premium account displaying floating values. Average spreads sit at 2.6 pips for GBP/USD, 2.1 pips for EUR/GBP and 1.1 pips for EUR/USD. The Fixed account offers fixed spreads that approximate average values for the Premium account, though they tend to be a little higher. The broker connects clients to markets around the world, from Europe through to Canada and beyond. Clients can access a range of advanced tools and features through the MetaTrader 4 platform, as well as VPS hosting, trading calculators and direct market analysis.

Support Links

Our review was impressed with the bonuses and promotions offered to clients. A 100% credit bonus is available on deposits between $100 and $30,000. However, investors must trade 100 lots before they can withdraw lmfx review the match bonus. The application supports all the order types available on the computer-based server, including stop losses, as well as real-time price quotes, one-tap trading, and full market history.

Does LMFX Accept US Clients?

The broker offers both fixed and variable spreads but spreads are subject to change. Since LMFX is unregulated, traders should exercise caution, particularly when dealing with an unregulated offshore broker. Any protections that investors may have through regulations will not apply to unregulated brokers like LMFX. LMFX says that traders funds are sent to individual client accounts that hold all the pooled funds separately to the funds of the company. If so, you’re likely looking for a platform capable of high trade volumes, that offers a wide variety of assets, and has low fees.

Is LMFX regulated?

This adds a layer of security to client funds in the unlikely event of liquidation. LMFX charges a commission of $4 per side on its Zero Account, which offers tight spreads. It does not charge commissions on its Micro, Fixed, and Premium Accounts. In the world of different types of Forex brokers, LMFX is an interesting one.

We offer impartial reviews of online brokers that are hand-written, edited and fact-checked by our research team, which spends thousands of hours each year assessing trading platforms. LMFX notes seven trading platform on its homepage, but it only provides traders with the below-average out-of-the-box MT4. It lists the availability for the MT4 as a desktop client, webtrader, and three mobile alternatives for a total of five versions of the same product. The MT4 infrastructure allows traders to upgrade the core version into a cutting-edge trading terminal, but it requires paid-for upgrades, which LMFX does not provide.

The VPS comes with LMFX MT4 Terminal installed so that you can start trading instantly. The servers are located next to the Trading environment for almost zero delays when trading whilst the infrastructure utilizes modern solid-state drive technology, for a super-fast trading experience. It also doesn’t have any restrictions on trading strategies, you are free to install any Expert Advisors, Indicators or Plugins of your choice. You can get the Forex VPS for just $20 per month or you can get it for free with any deposit equal to or greater than $5,000. A fixed account also offers a Personal Account Manager and bonus offerings. LMFX offers a good selection of flexible accounts to suit different traders needs and styles.

The broker gives you seamless market access via the popular MetaTrader 4 (MT4) platforms for desktop, web and mobile trading through the MT4 app. I like how they have deep liquidity pool that implements liquidity from various providers to ensure they can deliver fast https://forexbroker-listing.com/ execution speeds at the best market prices with minimal slippage. This makes them a suitable option for all trading strategies, including scalping and automated trading with expert advisors. I would compare them to Traders Way in terms of trading environment.

When writing this review, we were impressed with the prompt and helpful service we received from the customer support team. All the accounts offer fifth decimal pricing, access to MT4, and mobile trading. The platform supports automated trading through expert advisors (EAs) and boasts over 50 technical indicators, 30 charting tools, and 9 timeframes. There is also the capability to develop and customize indicators, and the platform is available in more than 30 languages.

No, US authorities and regulators restrict the sale of CFDs to residents. LMFX clients can take advantage of a 100% credit bonus match, which is available on deposits between $100 and $30,000. However, you will need to trade 100 lots before you can withdraw the bonus. The broker does still claim that they have segregated client fund accounts. This means that if the broker happens to go under or the company has to close, you should still be able to withdraw your trading capital. Whether this is actually true though with the case of LMFX, we cannot confirm – and hopefully will never have to.

- LMFX clients can take advantage of a 100% credit bonus match, which is available on deposits between $100 and $30,000.

- Traders can open an LMFX demo account to get a feel for the online trading markets and its conditions.

- The servers are located next to the Trading environment for almost zero delays when trading whilst the infrastructure utilizes modern solid-state drive technology, for a super-fast trading experience.

- No, US authorities and regulators restrict the sale of CFDs to residents.

It is a foreign exchange brokerage firm owned and operated by a company called Global Trade Partners Ltd. Although the domain name lmfx.com was registered back in 2005, our research suggests that LMFX started operating as a Forex broker as early as 2015. The web server of the company is hosted in Luxembourg, but the parent company is apparently registered in the Republic of North Macedonia.

It also does well in offering traders a selection of account types to meet different needs. No, the broker does not hold any licenses and does not fall under regulation by a financial agency. Instead, LMFX offers high leverage rates and fewer limitations in return for a riskier trading environment.

When trading via CFDs, you don’t take ownership of the underlying asset, which means you can take advantage of rising and falling markets by going long or short. The difference in price between the start and end of the CFD, is the profit or loss minus any applicable brokerage fees. Traders can open an LMFX demo account to get a feel for the online trading markets and its conditions. More experienced traders will be able to test strategies and experience the LMFX trading platform for free.

Much of this will depend on your investor eligibility with other platforms, which is largely based on your nationality and physical location. Accounts can be funded or emptied using bank wire transfers, payment cards (Visa and Mastercard), plus Skrill, Neteller, FasaPay and Load. Even though the LMFX contest uses virtual money with their demo inflatable website design accounts, the prizes each month are real cash that can then be used to trade on live accounts. Compare the markets and instruments offered by LMFX and its competitors.

The MT4 platform is popular with traders and has an intuitive user interface with a good range of features. MT4 allows you to view trading instruments, get quotes from the market, and load charts. If regulation is a crucial aspect of your trading experience, we recommend reviewing some safer alternatives from our list of best forex trading platforms. LMFX uses reputable payment providers to reduce the risk of payments not being processed. Furthermore, the broker uses single sockets layer (SSL) encryptions on all website traffic and holds all client capital in segregated bank accounts. The broker has a limited range of additional services and tools for clients.

LMFX have an extensive selection of educational materials that are aimed to guide you through the exciting world of financial markets. There is also the MT4 mobile platform for iOS and Android devices, which is very useful for clients who need to access their trading account from anywhere in the world, while on the go. The broker has some video tutorials, beginner trading course, and a MetaTrader4 platform course. Each course includes a series of videos to help with some standard information. Overall it’s quite standard, not very exciting, and could do with some more effort.

A VPS allows you to remotely run your trading platform 24/7 without needing your own computer switched on. This is useful for those who wish to keep an automated expert advisor running or those who do not have a reliable internet connection. The VPS comes with the LMFX MT4 trading platform already installed so that you can start trading instantly. It costs $20 per month or is free to clients who deposit into an LMFX trading account with at least $5,000.

The browser-based version of MetaTrader 4 provides clients with a readily accessible platform. Requiring no download, WebTrader offers most of the functionality of the desktop version while logging in from any computer with a browser. LMFX distinguishes itself from other brokers through its highly-leveraged forex trading services. Trade 46 major, minor and exotic pairs via CFDs with tight spreads, low latency and VPS support for automated trading strategies. Experienced traders who want highly leveraged CFDs and a choice between fixed and floating spreads should consider LMFX. On the downside, new clients should note the weak regulatory oversight.

Add Comment